Who pays this fee?

Account holders for developed properties within the city limits receive a statement for the city services fee.

Residential accounts pay $9 per month.

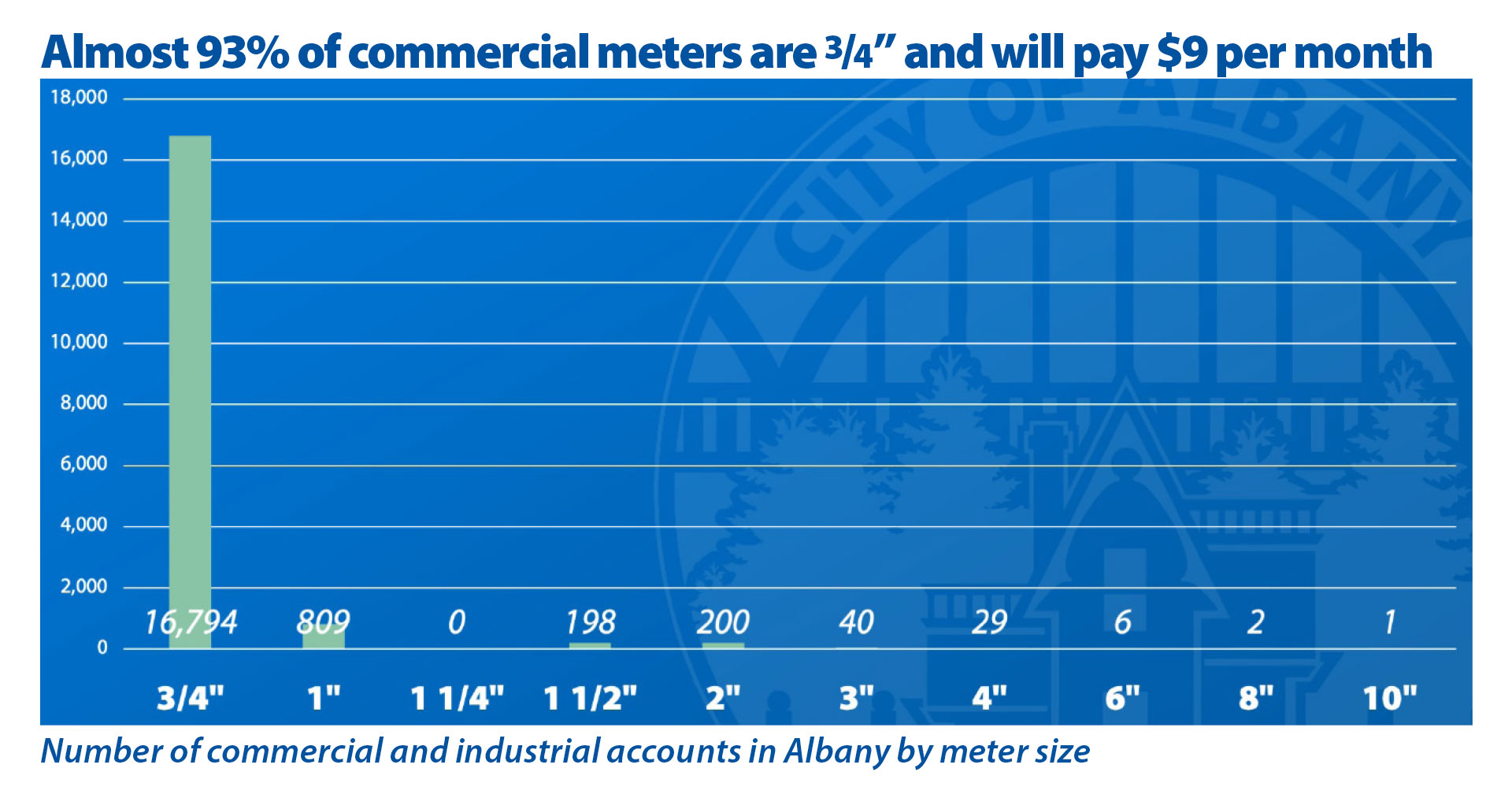

Businesses are charged a flat fee according to the size of their largest water meter. This is used to approximate the amount of city services they use. Most small businesses have a 3/4” meter and will also pay $9 per month.

What services am I getting for this fee?

Revenues from this fee would be used to address the budget shortfall for the 2021-2023 biennium. It would help to maintain our current service levels and programming for the next two years in Fire, Library, Municipal Court, Park Maintenance, and Police which will otherwise be reduced on July 1, 2021.

I already pay a lot of money in property taxes. Don't my property taxes pay for these services?

If you live inside the city limits of Albany in Linn County, only $0.37 of each dollar you pay in property taxes goes toward City of Albany services. The remaining $0.63 goes to Linn County, Greater Albany Public Schools, Linn-Benton Community College, and other small agencies. This is similar for properties in North Albany inside Benton County.

What about the public safety levy? I thought that paid for police and fire?

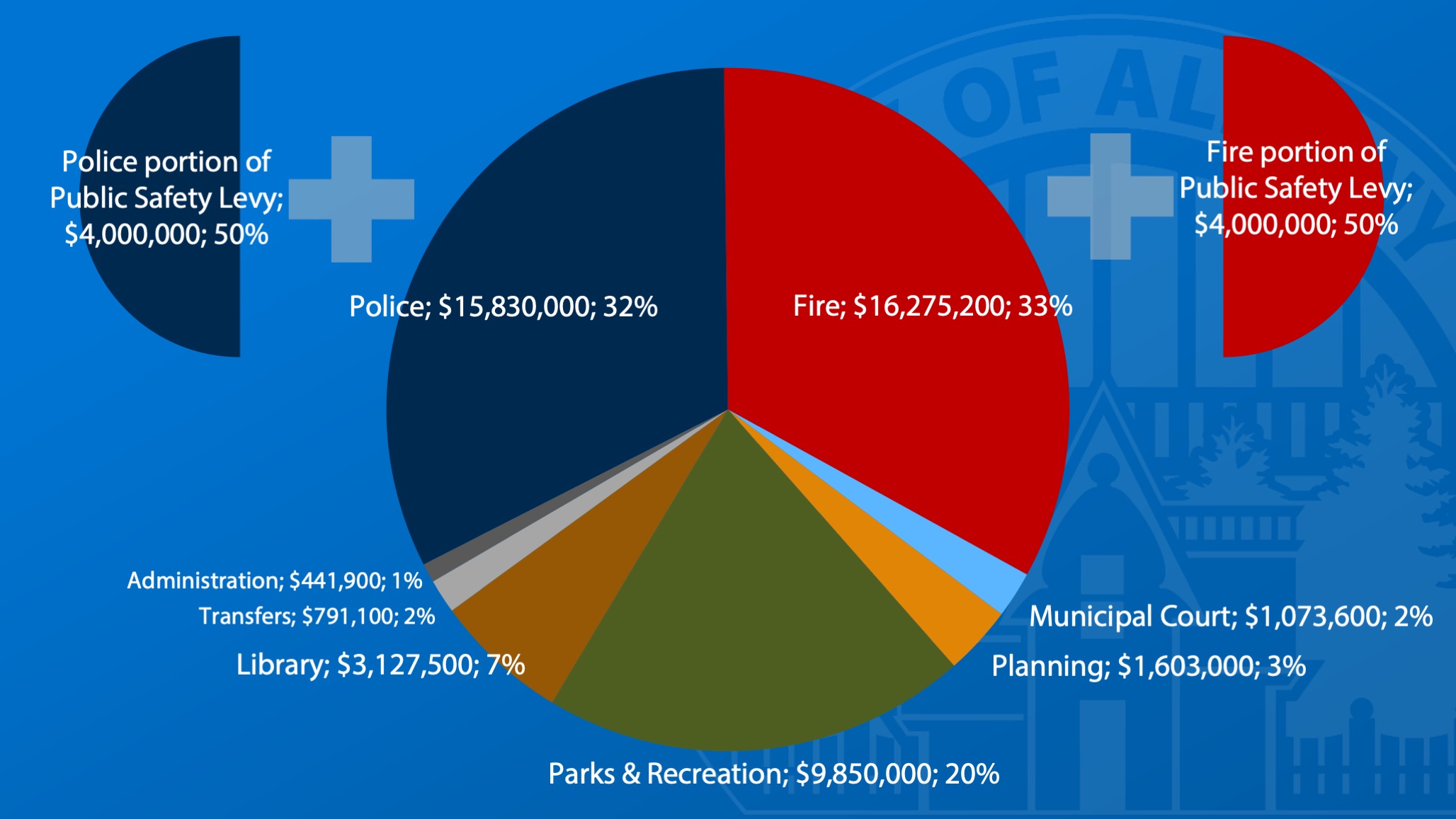

For each dollar of property tax you pay, $0.37 comes to the City of Albany. Approximately $0.05 of that is from the Public Safety Levy. These funds are given directly to Police and Fire. The levy was originally passed in November 2002 and has been renewed four times. The levied rate has not changed in almost 10 years. Expenses continue to climb with inflation and current compensation through collective bargaining agreements.

I already pay a lot of money on my water and sewer bill. Can't some of those funds be directed to the General Fund?

Your current City utility bill contains charges for water, wastewater (sewer), and stormwater services. These are referred to as Enterprise funds and are not interchangeable with General Fund revenues.

Do other communities in Oregon charge a utility fee? How much do they charge?

Approximately 50 communities in Oregon use some kind of fee to provide balanced and consistent funding beyond the limitations of current property tax assessments. The fee could be adjusted by City Council in the future if conditions change.

Why $9 per month?

Setting the fee at $9 per month would close the $5 million budget shortfall in the 2021-2023 biennium. This allows the City to maintain current service levels and programming for the next two years in Fire, Library, Municipal Court, Park Maintenance, and Police which would have otherwise been reduced on July 1, 2021.

Can this fee be adjusted?

The fee could be adjusted by City Council in the future if conditions change.

Is there any assistance for business owners?

There are several State and Federal programs offering temporary economic assistance for businesses. The City offers a low-income assistance program for residents. If you would like to discuss your business’s bill, contact the City at the number below to set up an appointment.

For more information on assistance programs, visit oregon4biz.com

Why not just tighten your belts and "trim the fat" in the budget?

We're continually looking for efficiencies, but it's not enough to close the gap. The City contends with rising costs that are often out of our control: software licenses, health insurance, cybersecurity threats, compliance with state and Federal laws, labor, materials, etc. Some cost savings can be achieved by combining, eliminating, or leaving positions unfilled, but doing so exposes the City to risks that potentially could come with their own significant financial or operational impacts. To maintain the current levels of service, especially in public safety, additional revenues must be generated to pay for the largest expenditure: personnel.

What about low-income people and seniors?

There is already a low-income program in place for seniors and those with disabilities to assist with water consumption charges. This program could be implemented immediately for this City Services Fee. At Council’s direction, staff is working to develop a less restrictive low-income assistance program for all City services.

What about RV parks?

RV parks are charged at the Multi-Famiily Residential rate.

What about hotels?

Hotels and motels are charged the Mixed Use Commercial rate per unit.

Does my City Services Fee come on the same bill as my water, sewer, and stormwater charges?

Yes. It will appear on your bill next to the other line item charges.

Why am I getting a utility bill from the City when I don’t have City water or sewer service?

Account holders for developed properties within the city limits receive a statement for the city services fee regardless of whether they have City water or sewer services as they receive a direct or indirect benefit from general City services (police, fire, parks, library, municipal court, planning).

The appropriate charge for an unmetered property based on its permitted use. Under the proposed rate structure, single family residential (SFR) properties would be charged the SFR rate of $9.00 per month. Since commercial and industrial customers are charged based on meter size, developed properties within those categories that do not have a water meter would be charged using a “meter equivalent” charge based on the type of operation and comparing them to similar operations within Albany that do have a water meter to the property.

The billing would default to the property owner of record. Unpaid charges would be subject to the same collections process used for unpaid water bills.

A developed property is defined as a lot or parcel, or portion thereof, of land within the corporate limits of the city that receives a direct or indirect benefit from City services. The assumption is that a developed property receives a direct or indirect benefit from City services if improvements exist on the premises or if the premises are served by a City utility system.

What about the funds from the American Rescue Plan Act (ARPA)?

On March 11, 2021, President Biden signed into law the $1.9 trillion relief bill commonly referred to as The American Rescue Plan Act of 2021, or ARPA. Overall, the bill will provide relief in many forms, to help recover from the effects of the coronavirus pandemic. Substantial funding is provided to local governments by either federal direct payments to metropolitan cities and counties or state payments to Non-Entitlement Units of Local Government. Albany has received $4.2 million and will receive another $4.2 million in May 2022. US Treasury guidance indicates that funds received can be used to:

- Support public health expenditures, by funding COVID-19 mitigation efforts, medical expenses, behavioral healthcare, and certain public health and safety staff;

- Address negative economic impacts caused by the public health emergency, including economic harms to workers, households, small businesses, impacted industries, and the public sector;

- Replace lost public sector revenue, using this funding to provide government services to the extent of the reduction in revenue experienced due to the pandemic;

- Provide premium pay for essential workers, offering additional support to those who have borne and will bear the greatest health risks because of their service in critical infrastructure sectors; and

- Invest in water, sewer, and broadband infrastructure, making necessary investments to improve access to clean drinking water, support vital wastewater and stormwater infrastructure, and to expand access to broadband internet.

The city manager formed a diverse group of community stakeholders to provide guidance on how these funds should be spent for the best community benefit. In May of 2021, to obtain some community feedback on the use of these funds, we asked 26 Albany residents to review 15 proposed projects and provide their ranking of the merit of these projects. We provided a staff evaluation of each project against the following criteria:

- Timeline: Can the project be completed by the deadline to expend the funds? (December 31, 2024)

- Yields recurring savings: To what extent will the investment save future operating costs? To what extent will it help avoid long-term operating costs?

- Assistance to citizens: How much of our community will benefit from the return on the investment? To what extent will marginalized communities benefit?

- Promotes long-term economic development: Does the investment stimulate/leverage private investment?

We received twenty responses ranking their priority of the projects presented that fit the criteria:

| 1 | Upgrade wireless network | $40,000 |

| 2 | Upgrade storage area network (SAN) | $300,000 |

| 3 | Generator for raw water pump station | $1,000,000 |

| 4 | Composting capacity improvements | $2,300,000 |

| 5 | AMWTP membrane modules | $650,000 |

| 6 | Provide capital for affordable housing development | scalable |

| 7 | Restore Parks & Recreation revenues | $1,055,000 |

| 8 | ADA improvements in parks | $200,000 |

| 9 | COVID pivot business forgivable loan/grant fund | $500,000 |

| 10 | Cox Creek interceptor | $7,600,000 |

| 11 | TLT revenue replacement | $1,000,000 |

| 12 | Ambulance revenue replacement | $220,000 |

| 13 | Defray water, wastewater, and stormwater fees | scalable |

| 14 | Bookmobile for library | $43,000 |

| 15 | Kempf site: Timber Street realignment | $7,000,000 |

These funds are one-time funds and as such, should not be used to plug operating budget holes. All projects shown support capital or major maintenance needs, and most are appropriate uses of one-time funds.

Although revenue replacement is an allowed use of ARPA funds, the US Treasury provides a formula that must be used to calculate lost revenue on an entity-wide basis. Using the US Treasury methodology, there was no revenue loss.

On August 25, 2021, City Council authorized the funding of projects identified as 1, 2, 3, 8, and 14.

How do Public Employee Retirement System (PERS) and wage-related costs affect the City of Albany?

City services rely on people. Costs to provide service have increased as the cost of public sector retirement escalates and as the City of Albany remains a competitive employer within the community. PERS increases are impacting all local governments. On July 1, 2019, a PERS employer rate increase went into effect as determined by the State of Oregon. Depending on the employee plan (referred to as Tier One, Tier Two, OPSRP), that rate increase ranges from 21.0% to 37.1%. Additional rate increases are also scheduled for the next rate cycle that begins July 1, 2021.

| Net Employer Contribution Rate | Tier 1 & 2 Payroll | OPSRP General Service Payroll | OPSRP Police and Fire Payroll |

|---|---|---|---|

| 2019-2021 | 26.51% | 17.27% | 21.90% |

| 2021-2023 | 26.19% | 19.46% | 23.82% |

There are multiple efforts underway at the state level to reduce the PERS obligation on local governments.

What is the General Fund?

The City's General Fund supports police, fire, municipal court, park maintenance and recreation programming, library services and programming, short- and long-range planning, code enforcement, emergency preparedness and response, and other services that provide a communitywide benefit. To date, the City has funded the difference through a combination of cuts to staffing, programs, and services along with using one-time funds and reserves.

The City's financial health is measured by its ability to align its expenditures with its anticipated revenues while maintaining a fiscally responsible level of reserves. The use of one-time funds or reserves for ongoing expenses is a sign of an unhealthy and imbalanced budget. A lack of sufficient reserves affects the City's ability to borrow money at a reasonable rate for essential capital improvements and puts the City at risk in the event of unforeseen expenses, such as those realized during the COVID-19 pandemic.